Get the free commingling agreement

Show details

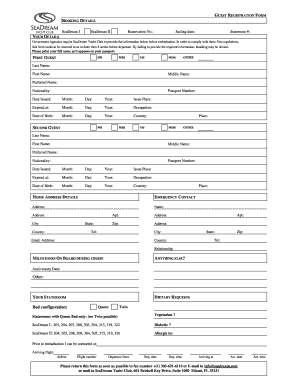

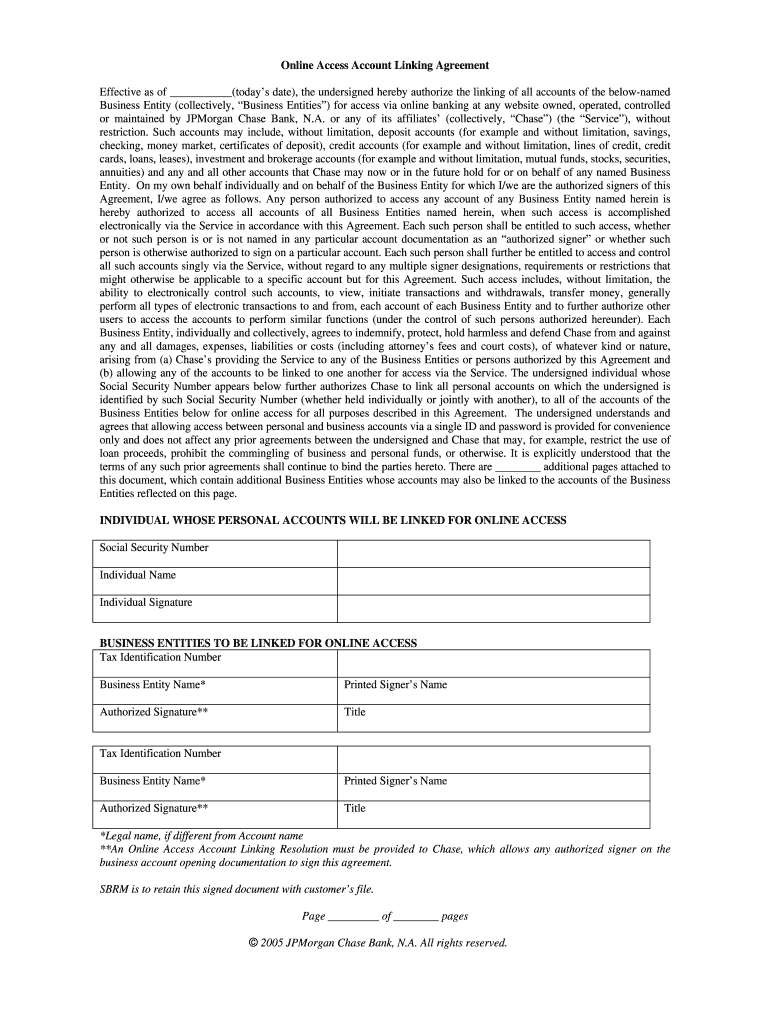

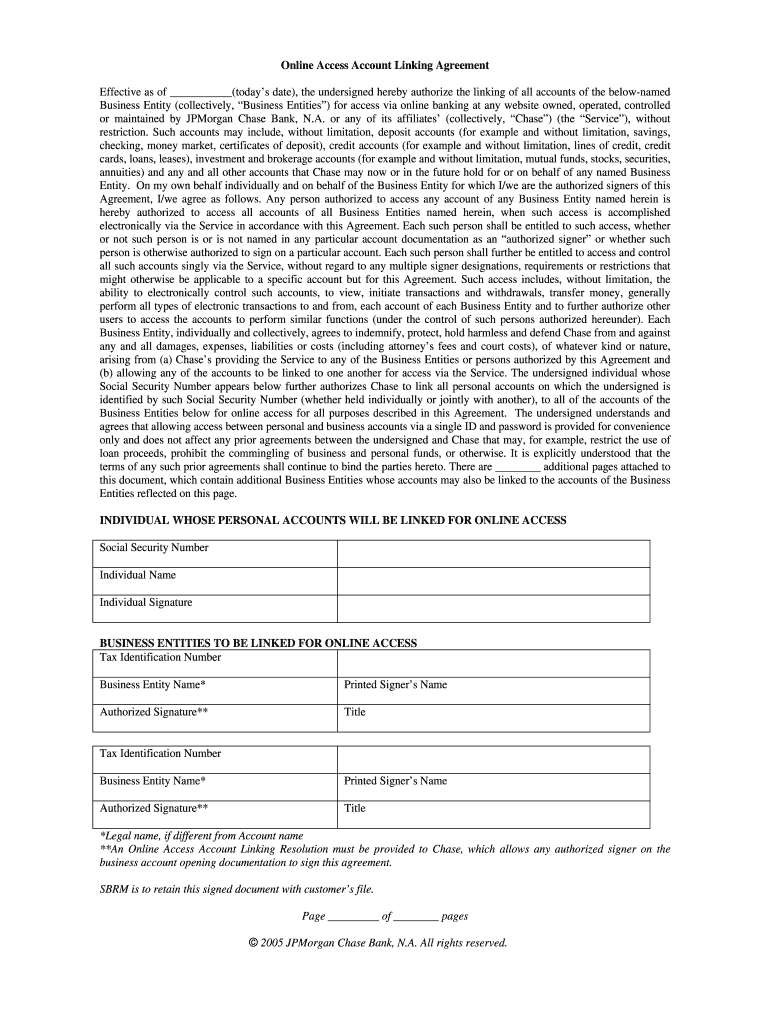

Online Access Account Linking Agreement Effective as of (today's date), the undersigned hereby authorize the linking of all accounts of the below-named Business Entity (collectively, Business Entity

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commingled files form

Edit your commingled records form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commingling agreement form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing commingling agreement form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit commingling agreement form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commingling agreement form

How to fill out a commingling agreement:

01

Start by gathering all necessary information and documents. This may include company details, names of parties involved, and any relevant legal or financial documents.

02

Carefully read through the agreement to understand its terms and conditions. Pay close attention to any specific requirements or clauses.

03

Fill in the required information in the designated fields. This may include the names of the parties involved, contact information, and the purpose of the commingling agreement.

04

Provide detailed descriptions of the assets or funds that will be commingled. Include any specific terms or conditions related to the commingling process.

05

If applicable, outline the distribution or allocation of commingled assets or funds. Specify how profits or losses will be divided among the parties involved.

06

Review the completed agreement for accuracy and completeness. Make any necessary revisions or additions.

07

Sign the agreement along with all other parties involved. It is advisable to have the signatures notarized for added legal validity.

08

Keep a copy of the signed agreement for your records.

Who needs a commingling agreement?

01

Businesses or individuals who intend to pool their assets or funds together for a specific purpose.

02

Investors or partners who want to jointly hold or manage assets.

03

Organizations or entities seeking to establish clear guidelines for the division or distribution of commingled assets or funds.

Fill

form

: Try Risk Free

People Also Ask about

What is a commingling agreement?

Commingling means the sorting of beverage containers at a redemption center by material type and size rather than by beverage brand in ance with the requirements of an approved commingling agreement.

What is the legal term commingling?

Commingling refers broadly to the mixing of funds belonging to one party with funds belonging to another party. It most often describes a fiduciary's improper mixing of their personal funds with funds belonging to a client.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute commingling agreement form online?

pdfFiller makes it easy to finish and sign commingling agreement form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an eSignature for the commingling agreement form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your commingling agreement form right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit commingling agreement form on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute commingling agreement form from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is commingling agreement?

A commingling agreement is a legal contract that outlines the terms and conditions under which multiple parties can mix or share assets, funds, or resources while still maintaining individual ownership and accountability.

Who is required to file commingling agreement?

Parties who are involved in a joint venture, partnership, or any arrangement where resources are shared and require clarity on the management of those shared assets are typically required to file a commingling agreement.

How to fill out commingling agreement?

To fill out a commingling agreement, parties should provide their names and contact information, specify the assets being commingled, outline the terms of sharing, responsibilities of each party, and include provisions for dispute resolution or termination.

What is the purpose of commingling agreement?

The purpose of a commingling agreement is to formalize the arrangement between parties regarding the joint use of resources, protect their rights, provide clarity on ownership and responsibilities, and prevent disputes.

What information must be reported on commingling agreement?

Information that must be reported on a commingling agreement includes the identities of the parties involved, description of the assets being commingled, purpose of the commingling, terms of use, and any related financial obligations or liabilities.

Fill out your commingling agreement form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commingling Agreement Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.